In 2026, dividend investing remains one of the most dependable ways to generate passive income. By investing in companies that regularly pay dividends or in ETFs that bundle them, you can earn quarterly (or monthly) payouts with minimal ongoing effort. Focus on reliable payers like Dividend Kings — companies with 50+ consecutive years of dividend increases — for stability and growth potential.

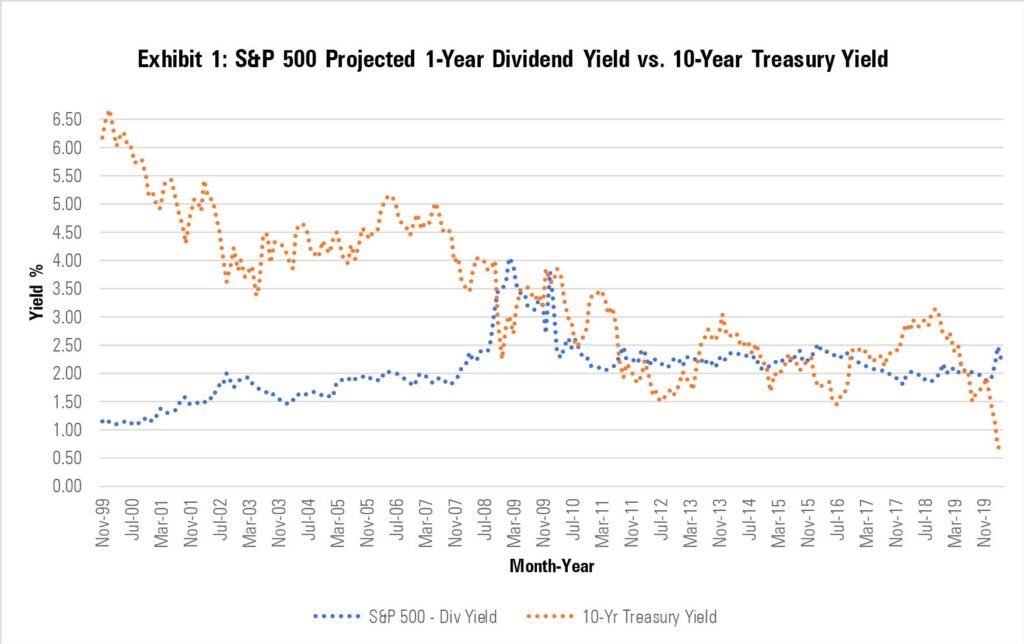

As of January 2026, the S&P 500’s average dividend yield sits around 1.1–1.4%, making targeted dividend strategies far more attractive for income seekers.

Why Dividend Stocks and ETFs for Passive Income?

- Regular Cash Flow: Most pay quarterly, providing steady income.

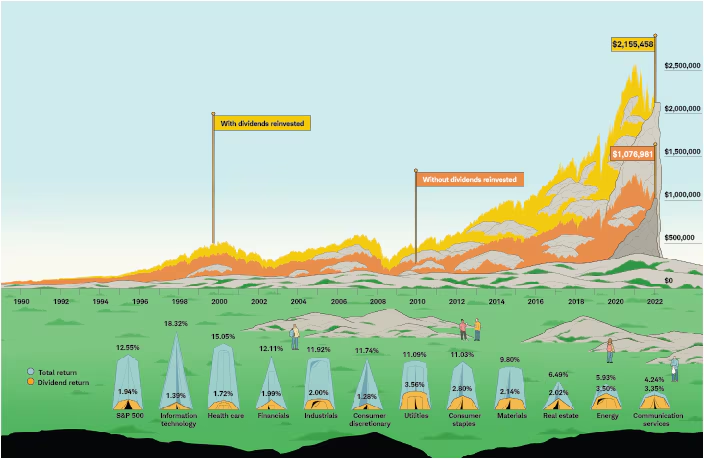

- Compounding Power: Reinvesting dividends accelerates growth over time.

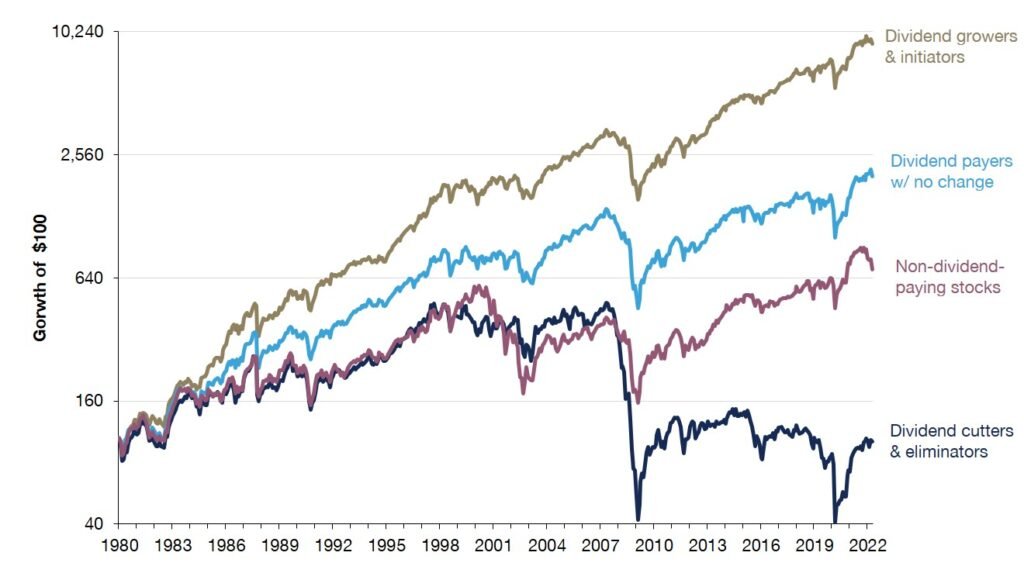

- Lower Volatility: Dividend payers often outperform in down markets.

- Inflation Hedge: Many companies (especially Kings) raise dividends annually.

This illustration shows how reinvesting dividends can turn a modest investment into substantial wealth through compounding.

Focus on Dividend Kings: The Gold Standard

Dividend Kings have raised payouts for at least 50 years, proving resilience through recessions, inflation, and market crashes. Examples include:

- Procter & Gamble (PG): A consumer staples giant with everyday brands like Tide and Pampers. Current yield: ~3.0%. Known for consistent increases.

- AbbVie (ABBV): Pharma leader with blockbuster drugs like Humira (and successors). Current yield: ~3.0%. Strong pipeline supports ongoing growth.

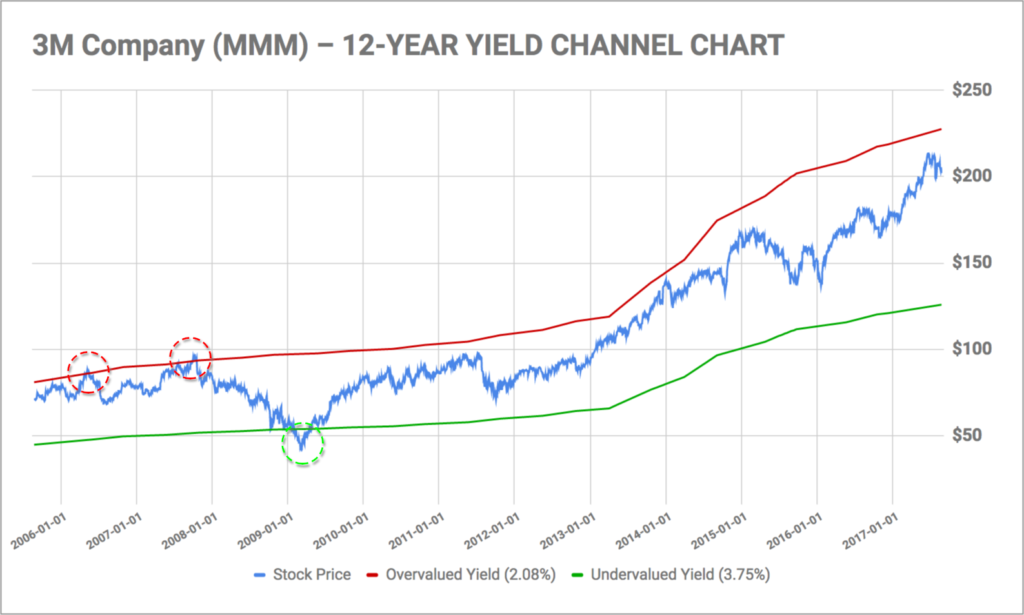

These charts highlight how dividend growth stocks have historically delivered superior long-term returns.

Other notable Kings: Johnson & Johnson (JNJ), Coca-Cola (KO), and Kimberly-Clark (KMB).

Easier Option: Dividend ETFs

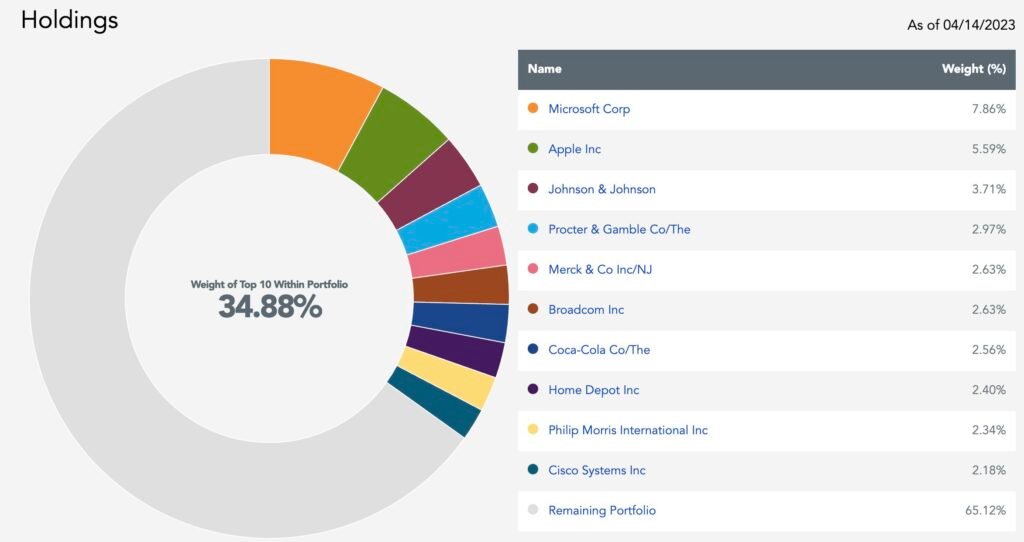

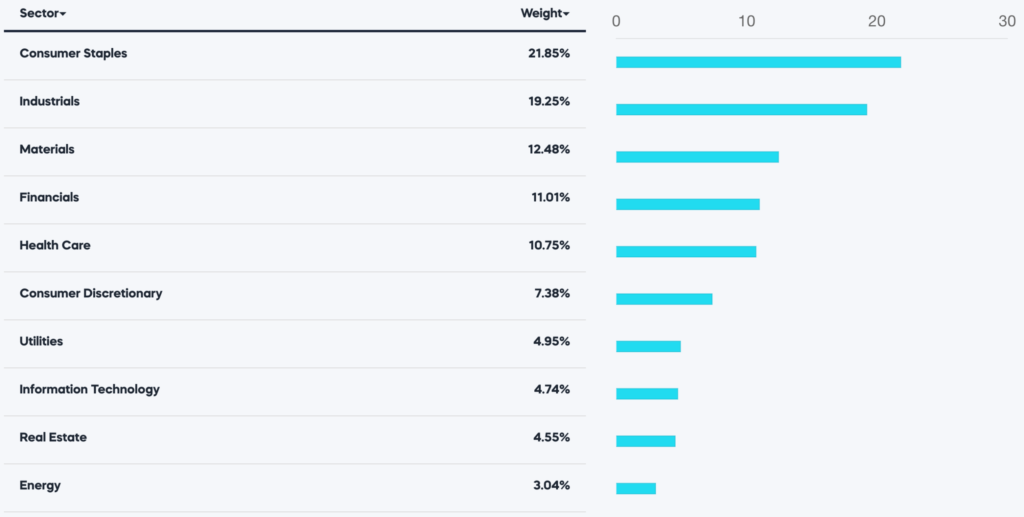

For beginners or those preferring diversification, ETFs are ideal — instant portfolio of 100+ stocks, low fees, and automatic reinvestment options.

Top Picks for 2026:

- Schwab U.S. Dividend Equity ETF (SCHD)

- Yield: ~3.7–3.8%

- Focus: High-quality companies with strong dividend history and fundamentals.

- Expense Ratio: 0.06% (ultra-low).

- Why now: Outperforms in value rotations; strong candidate for 2026 gains.

- Vanguard High Dividend Yield ETF (VYM)

- Yield: ~2.4%

- Focus: Higher-yielding large-cap stocks.

- Expense Ratio: Low-cost Vanguard standard.

- Great for broad exposure with solid income.

These comparisons show how top dividend ETFs stack up in yield, growth, and performance.

Realistic Earnings Example

- Invest $10,000 in SCHD at 3.7% yield → ~$370/year initial income.

- With 5–10% average annual dividend growth + reinvestment → Could double in 10–15 years via compounding.

Getting Started in 2026

- Open a brokerage account (e.g., Schwab, Vanguard, Fidelity).

- Research via free tools or screeners.

- Start small and enable DRIP (Dividend Reinvestment Plan).

- Diversify: Mix individual Kings with ETFs.

- Be patient — dividends shine over decades.

Dividend investing isn’t flashy, but it’s proven. In uncertain markets, reliable payouts provide both income and peace of mind.

Ready to build your dividend portfolio? Which stock or ETF interests you most?

Leave a Reply